| Shanxi province 山西省 King Coal’s misrule 煤炭王的暴政 The rise and fall of a corrupt coal-fuelled economy 腐化燃煤经济的沉浮  1 IT TAKES half an hour to walk down 1,400 rickety wooden steps from a pithead of Jinhuagong mine to the coal face, 400 metres below. At the top, grimy miners tramp home. At the bottom stand a theodolite, a flame-proof telephone and a double-drum electrical traction shearer—a behemoth of a machine designed to chew up the coal face and excrete its fragments onto a conveyor belt. 从晋华宫矿的矿井井口到400米深的煤层要经过1400阶摇摇晃晃的木梯,而走这一趟需要1个半小时。在地面上,满身煤污的矿工迈着沉重的脚步回家。在矿井底,你能看到经纬仪、防火电话以及双滚筒电子牵引采煤机,这种巨型机械用于处理表层煤矿,并将粉碎后的产物放到传送带上。 2 But the pithead, in the northern province of Shanxi near its coal capital, Datong, is not operational. It was closed in 2012 and converted into a tourist attraction (with a theme: “the glory of Datong coal”). Perhaps put off by the trek, on most days visitors are rare. The mine’s state-owned operator, Datong Coal Mining Group, is trying to revive its fortunes by diversifying into tourism. It is not proving easy. Its fumbled attempts to reinvent itself symbolise the problems Shanxi as a whole is facing. 但在中国北方省份山西省的煤矿中心大同市附近,有的煤矿已经不再生产。该煤矿在2012年停止生产,但摇身一变成为游览景点(主打理念是“大同煤的荣光”)。但可能是因为路途坚信,在多数日子里游客数量都很少。该煤矿由国有企业大同煤矿集团运营,集团希望通过加入旅游业的元素来多元化企业财富。但事情没有这么简单,从大同煤矿集团对自我道路的摸索,我们正好可以看到山西作为一个煤矿大省现在所面临的问题。 3 As China slows, many economists pin their hopes for continued growth on poorer inland provinces. By taking advantage of cheap labour and land, the theory goes, these places should be able to grow more quickly than richer coastal areas. Shanxi, 250 miles (400km) east of Beijing, would seem a good candidate for catch-up growth. It is relatively poor, with a GDP per person of 35,000 yuan ($5,500), or 75% of the national average. It has a population of 36m people, about the same as Canada’s, as well as respected universities and good transport links with the coast. It ought to be steaming ahead. Instead, last year, it had the slowest growth of any province: just 4.9%. In the first nine months of 2015, this slowed to only 2.8% compared with the same period a year earlier. Only Liaoning province in the north-eastern rustbelt fared worse. 因为中国经济增长放缓,许多经济学家将实现持续增长的希望放在了不太发达的内陆省份。根据他们的理论,这些较落后地区因为低价的人工和土地,能实现比较为富裕的沿海地区更快的经济发展。山西位于北京往西250英里(400公里)的地方,山西的经济发展或许是弥补中国经济放缓的发动机。山西省相较不太富裕,年人均GDP为350000元(5500美元),只有全国平均水平的75%。山西省人口高达3600万,数量与加拿大相当。同时在山西省内有着和沿海地区一样有名的大学,且山西省与沿海地区的交通方便。这么一来,山西经济应该一路向前。但相反的是,去年山西的经济增长位列所有省份的末尾,仅有4.9%。同步去年同一时期,在2015年前九个月,山西的经济增长放缓至仅有2.8%。在“锈带”省份中,仅有东北省份辽宁的表现比山西差。 4 Three factors explain Shanxi’s failings: coal, corruption and construction. The province is the historic centre of China’s coal industry. Though its output was overtaken by that of neighbouring Inner Mongolia in 2009, Shanxi still produces a quarter of the country’s coal. About 60% of provincial GDP is tied to the black stuff. 山西的经济困难有三个原因:煤、贪、建。山西是中国煤矿业的历史中心。尽管山西的煤炭产量在2009年已经被邻省内蒙古,这一数字依然占了全国煤炭产量的四分之一。该省60%的GDP都和这个黑家伙有关。 5 The business boomed in the 2000s thanks to soaring energy demand (see chart) and the freeing of coal prices, which had been kept artificially low. But the boom was short-lived. Worried by pollution, the central government began trying to reduce China’s coal use. Shanxi has been taking the hit. Capital investment in the province’s coal industry fell last year by 6%. The local government says it will not approve construction of new mines for the next five years. But shrugging off coal dependence is hard. Ignoring its own pledge, Shanxi approved 24 new coal projects in the first nine months of this year, more than any other province. 因为能源价格上涨以及一直被人为设置低价(如图)的燃煤价格放开,煤产业在21世纪初蓬勃发展。但这个蓬勃发展仅是昙花一现。中央政府出于对环境污染的担忧,开始减少国内煤炭使用量,山西经济开始遭受冲击。当地政府宣布在接下来五年内不允许新建煤矿,对山西煤炭产业的资本投资去年下降了6%。但摆脱经济对煤炭的依赖实属不易。山西省政府没有按照说的话做,在今年前九个月里就批准新开了24个煤矿项目,是各省级行政区中最多的。  6 And now prices are falling as China’s economy slows and the drivers of growth change to less-coal-consuming ones, such as services. China’s benchmark coal price was 374 yuan a tonne at the end of October, a 27% decline so far this year. Local prices for unwashed, low-quality coal have fallen further still. Because so many of Shanxi’s mines are old they are relatively expensive to run. Most are losing money. 而现在,煤炭价格随着中国经济增长放缓而下架,同时增长的驱动力向低能耗的产业转移,例如服务业。10月末,中国的煤炭基准价是374元每吨,该数字今年以来已经下降了27%。而当地未经处理的低质煤价格下降的幅度更大。此外许多山西的煤矿因为开采时间久,运营成本相对较高。许多煤矿都在赔钱。 7 The response has been a wave of consolidation. In 2008 the province had 2,600 coal mines. Many of these were small privately owned collieries, at which safety standards were usually atrocious. Most of the private ones have been closed or taken over by state-owned enterprises (SOEs). The number of mines has fallen by almost two-thirds. Safety standards have improved considerably. 面对这些困境,山西的煤炭厂商做出的反应是大范围的合并。2008年,山西省境内有2600个煤矿。其中大多数为私人所有,其环境安全堪忧。现在大多数的私营煤矿都被取缔或者由大型国有企业收购。煤矿的数量下降了将近三分之二,煤矿安全标准大幅提高。 8 But three-quarters of provincial output now comes from SOEs—with predictable results. Gone is the entrepreneurial vigour that the private sector once gave the industry, say locals involved in the business. State firms are reverting to type: keeping everyone they can on the payroll, squeezing wages, and hoping the provincial government will bail them out. 但山西省四分之三的煤炭产量由国有企业提供——而结果可想而知。当地人的参与使得煤炭业生机蓬勃,但在私营企业退出该产业后,煤炭业的商业活力不复存在。国有企业将一切恢复为原来的样子:留住在岗工人,压缩薪酬,同时希望省政府能够扶持他们。 9 It won’t. This is because Shanxi, as well as being the capital of coal, is the centre of President Xi Jinping’s anti-corruption campaign. Since 2013, seven of the 13 members of Shanxi’s Communist Party committee (the province’s leaders, basically) have been arrested or charged with “infractions of party discipline”, a term that usually means taking bribes. In all, 50 high-ranking officials have been placed under investigation for graft. For its size, the province has had more leaders arrested or jailed than anywhere else. 但这样的好事不会发生,因为煤矿中心的山西同样也是习近平主席反贪行动的中心。自2013年来,13位山西省共产党委员会会员(基本上都是山西省的领导班)中的7位已被拘留或者被冠以“扰乱党内纪律”的罪名,而这个罪名一般都是指收取贿赂。总体来看,已经有50位高官因为贪腐问题被调查。就人数来说,山西省被调查或监禁的领导比其他地方多。 10 Corruption, coal and politics have long been inextricably linked in Shanxi. In 2014 Caixin, a magazine in Beijing, investigated Luliang county in the west of the province. It found that coal bosses there were spending $150,000 a year on bribes; one county-government job had changed hands for $650,000. 贪污、煤炭以及政治在山西省一直以来都有着千丝万缕的关系。2014年,北京的一本杂志《财新》采访了山西省西部的陆良村。采访发现,当地煤矿主每年话15万美元用于贿赂官员,其中一个村政府的职务以65万元成交。 11 Though corruption was bad, the campaign against it is also taking a toll. Wang Rulin, Shanxi’s party chief, complains that he cannot fill about 300 local-government posts because people are too scared to apply—or they think that party jobs are not worth having now they have to be clean. One executive in the coal industry complains that officials “used to take money and help us; now they don’t take money and don’t help either.” 尽管贪污是坏事,反贪运动同样造成了一定的冲击。山西省委书记王儒林对此有所抱怨。有的人对贪污查处有所担忧,而有的人认为政府工作现在清廉的特性没有吸引力,这导致了当地政府有300个左右的职位空缺无法填满,一位工作在煤炭企业的管理人员称“政府以前收钱替我们办事,现在他们既不收钱也不办事”。 12 The hangover from cosy relations between coal and politics is visible in the form of half-constructed residential blocks, which loom over the outskirts of even the smallest town. During the boom of the 2000s, coal bosses and local officials got together to pour money into house-building. Investment in property in Shanxi rose from 66 billion yuan in 2008 to 248 billion in 2013. The area under construction for residential use more than doubled to 179m square metres in the same period. Even by Chinese standards, this was extraordinary. The area under construction in Beijing expanded by only 40%. Such development can keep economic activity going for a while. But a housing boom on this scale is always risky. To judge by the empty space, Shanxi has built far too much. 到现在,煤炭业和政府间暧昧的关系依然能从半完工的住宅大楼中看到一丝蛛丝马迹,这些大楼耸立在一些城镇的外围,其中就包括那些小村落。在21世纪初蓬勃发展的阶段,煤矿老板和政府官员一起注资房地站。山西的地产投资从2008年的660亿上升到2013年的248亿。用于建设住宅用房的地区面积在同一时间段翻了一倍,上升到1790万平方米。即使是以中国的标准来看,这数字也是不同寻常的了。而在北京,用于建设的地区面积仅上升了40%。这样的发展让山西的经济增长持续了一段时间,但如此规模房地产市场的兴起总是内涵一定风险的。从闲置率能看出,山西建了太多不需要的房子。 13 The government’s hope that inland provinces will become new engines of growth rests on a belief that cheap labour and land are vital ingredients of it. But Shanxi shows that these advantages do not necessarily help as much as having a diversified, service-oriented economy. The problem is not that the province has failed to attract new businesses. It has two smartphone factories owned by Foxconn, a Taiwanese consumer-electronics company, which are its main source of foreign-currency earnings. But the losses of the coal sector offset gains made elsewhere. 政府希望内陆省份能够变成经济增长的新动力,因为其所有的低廉人工和土地是经济发展的重要因素。但山西的例子告诉我们这些优势对经济发展的作用没有一个多元化、服务导向的经济来的实际。问题不在于山西无法形成新的产业。台湾消费电子产品企业富士康在山西设立了两家智能手机组装工厂,成为山西省外汇收入的主要来源。但煤炭产业上的损失抵消了其他地方所获取的利润。 14 Shanxi is unusual among China’s provinces in being so dependent on coal. But some of its problems beset the whole country: corruption, unproductive investment and over-mighty SOEs. The country’s inadequate provision of pensions and unemployment benefits results in workers preferring to stay with SOEs which promise to look after them rather than strike out on their own. Leaders in Beijing sometimes make it sound as if the economy’s transition from manufacturing-led to services-led growth is going smoothly. In Shanxi the path is very bumpy. As at the Jinhuagong mine-cum-theme-park, it takes even longer to trudge back up to the surface than it does to walk down. 山西对于煤炭的依赖在中国的省级行政区是不常见的。但有的问题是其他地方都存在的,例如贪污、无生产作用的投资以及权力过大的国有企业。中国养老金和低保的不足使得人们更希望在福利较好的国有企业工作,而不是自己出来冒风险。中央政府的文件有时会让人觉得中国的经济增长从制造导向到服务导向的转变进行得很顺利。然而在山西,这条路总是磕磕绊绊。就像在晋华宫的煤炭主题园一样,从下层往上层走的时间肯定要从地表往煤矿里走的时间长。 本文地址:http://www.economist.com/news/china/21679263-rise-and-fall-corrupt-coal-fuelled-economy-king-coals-misrule |

西西米兰 发表于 2015-11-30 16:20

Luliang county 这个应该是指山西西部的吕梁地区。

zhengdetaileile: 百度不出来所以只能音译,谢谢点评!

RK三顺 发表于 2015-12-25 16:16

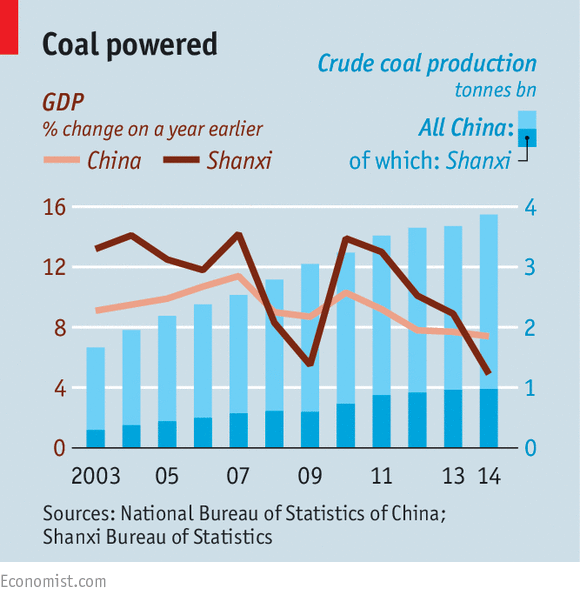

是的,是吕梁县。“尽管山西的煤炭产量在2009年已经被邻省内蒙古,这一数字依然占了全国煤炭产量的四分之 ...

MagicWeirdo 发表于 2016-3-14 11:28

misrule是“统治或者管理里不当”,tyranny才是“暴政”呐。其实标题可以是“煤王的陨落”。 ...

|小黑屋|手机版|网站地图|关于我们|ECO中文网

( 京ICP备06039041号 )

|小黑屋|手机版|网站地图|关于我们|ECO中文网

( 京ICP备06039041号 )

GMT+8, 2025-7-4 12:04 , Processed in 0.156988 second(s), 25 queries .

Powered by Discuz! X3.3

© 2001-2017 Comsenz Inc.